Financial Risk Report

Get clarity – with the Financial Risk Report

Can your service providers and suppliers cope with the current financial challenges as a company? Find out with the Financial Risk Report.

The BAMAC Group’s Financial Risk Report offers you a reliable evaluation basis based on objective analyses, which you can use to evaluate your service providers, assess risks and establish and expand promising relationships.

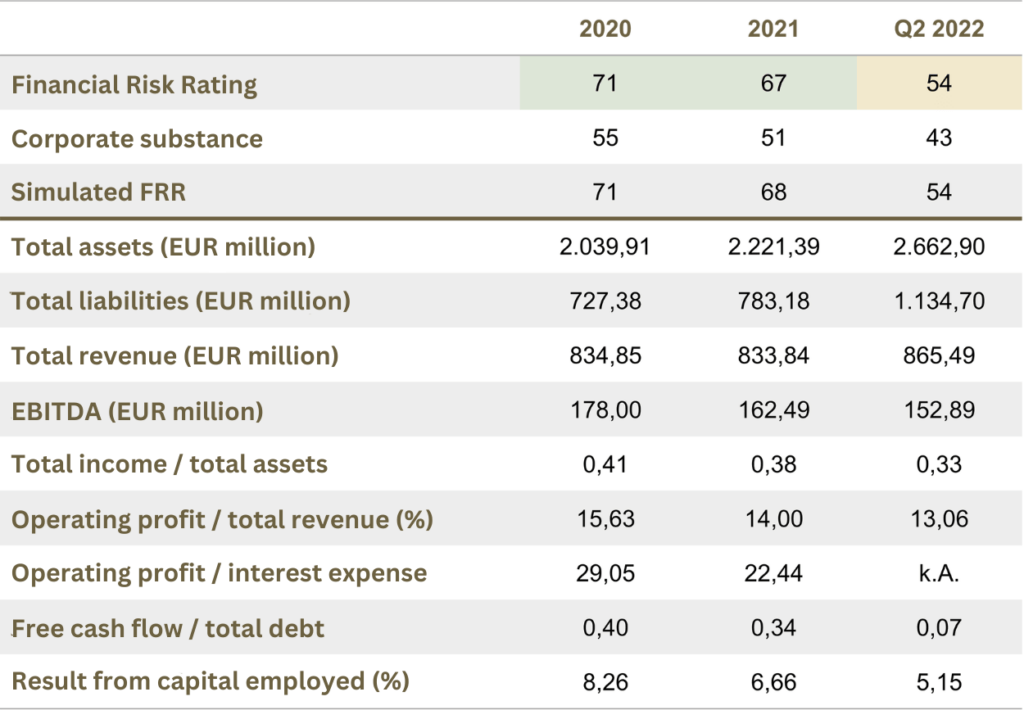

The Financial Risk Rating

The financial risk rating allows you to immediately recognise the economic stability of your service provider. The rating is derived from an in-depth analysis of all key economic figures and takes into account both the company’s substance and its resilience. The default risk can be reliably derived from this. This makes the financial risk rating a key indicator that you can use to make decisions for the long-term success of your company.

Accuracy.

The reliability of our Financial Risk Reports is proven. Of 1600 companies that filed for insolvency between 1991 and 2019, 90% had a Financial Risk Rating of less than 22 out of 100 immediately prior to default. 12 months prior to default, the average FRR was 32.

Clarity.

Our analyses follow transparent rules and are reproducible at any time. We provide clear assessments in the interests of our clients. The Financial Risk Rating summarises the comprehensive assessments in a key figure and thus offers comparability.

Independent.

Our financial risk reports are based on objective analyses that are carried out independently. All reports contain a presentation of all the factors analysed and are therefore as comprehensible and transparent as possible.

Need Help?

Monday through Friday from 08:00 - 18:00

Our references

The most popular posts on the Financial Risk Report in our blog