Study Sustainability PHI 2025

Our analysis of 47 private health insurers reveals:

Determined implementation of regulations, but insurance companies often lack a focus on efficient processes and economic benefits. Find out your position in an industry comparison.

The sustainable transformation of private health insurance (PHI) has long been underway. But how effective and economical are the measures taken so far? The BAMAC Study Sustainability PHI 2025 provides the answers.

Sustainability is becoming a strategic obligation – efficiency and profitability are often the blind spots. The Study Sustainability PHI 2025 shows where your company stands in comparison to the rest of the industry and which potentials remain untapped.

Regulation, expectations, competition: the complexity of sustainability in private health insurance.

The demands on private health insurance are constantly increasing and are diverse:

- Regulation: Current and upcoming legal requirements such as CSRD, SCDDA (Supply Chain Due Diligence Act), Solvency II and others increase the requirements for transparency, reporting and verifiability.

- Stakeholder Expectations: Customers, employees and investors are demanding transparent, responsible action – and are recognising greenwashing faster than ever before.

- Competition: Sustainability is increasingly becoming a strategic competitive factor. Companies with a clear ESG strategy are more attractive to talent, investors and policyholders.

The Problem: although most private health insurers implement regulatory standards, there is often a lack of systematisation when it comes to efficient implementation – and, above all, economic classification. Many measures remain redundant piecework.

The central question remains unanswered: How does sustainability benefit your company in concrete terms – economically, strategically, structurally?

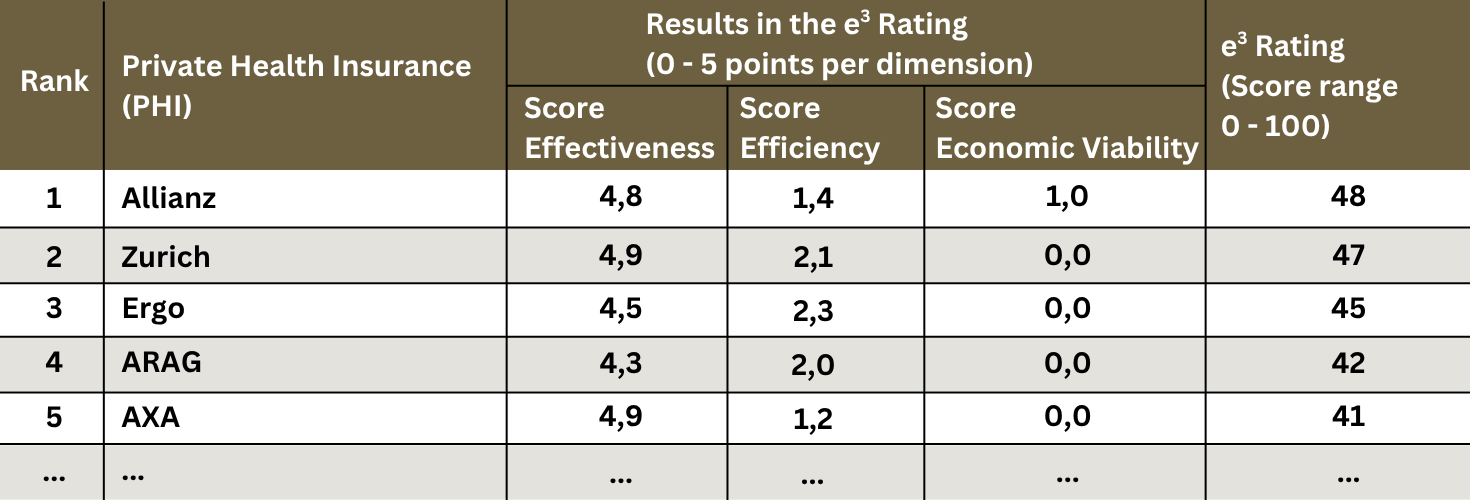

Multidimensional clarity: The e³ rating for your strategic positioning.

With our specially developed Sustainability e³-Rating, we offer a well-founded, multi-dimensional assessment specifically for private health insurance companies for the first time. It not only shows whether you are ‘doing something’, but also how good, how efficient and how value-adding your measures really are.

The three dimensions at a glance:

- e1 – Effectiveness: To what extent do you fulfil regulatory standards and ESG requirements? How high is the degree of implementation of your sustainability strategy?

- e2 – Efficiency: How lean, effective and integrated are your ESG-related processes, governance structures, data flows and IT systems?

- e3 – Economic Viability: What measurable contribution does your sustainability strategy make to sales, cost reduction and improved results?

As you can see: Our approach goes beyond standard ratings, provides a 360° view and identifies previously untapped opportunities. Our e³ rating creates transparency about your positioning and uncovers unutilised efficiency and value creation potential.

Our Methodology: Systematic, Detailed, Comparable.

For the BAMAC Study Sustainability PHI 2025, we systematically analysed 47 relevant private health insurers in Germany 1 – based on publicly available company information (cut-off date: 31.12.2023).

Our approach:

- Assessment based on 26 specific criteria, developed on the basis of international standards (including CSRD, GRI, DNK, LkSG, UNGC, Solvency II, SFCR).

- Combined with AI-supported data analysis and proven BAMAC process models.

- Implementation in the ‘black box procedure’: purely on the basis of published information – objective and comprehensible.

Our methodology combines AI-supported analysis, tried-and-tested process models and the experience of over 25 years of BAMAC expertise in strategy, sustainability and business optimisation

PKV Industry Insights: Where are the strengths, where is the need for action?

The industry is on its way, but with clear differences.

The study shows: Implementation (effectiveness) is pursued, but efficiency and cost-effectiveness often lag behind.

It is clear that many companies are already achieving high scores in the implementation of regulatory requirements. At the same time, considerable weaknesses in operational efficiency and economic impact are becoming apparent.

Use our study to categorise your own position and develop targeted measures.

Find out where your company stands!

Your Advantage: From knowledge to action.

The Study Sustainability PHI 2025 provides an objective assessment of your insurance company’s position compared to the rest of the industry. You will receive specific measures for action, optimisation potential and individual recommendations in the comprehensive results report, which is tailored specifically to your company.

This in-depth analysis not only gives you clarity about your position in the market. The benefits of our Study Sustainability PHI 2025 and its customised results report are manifold – strategically, operationally and communicatively. See for yourself:

- Objective Location Analysis: Transparent categorisation of your ESG performance along the dimensions of effectiveness, efficiency and profitability – in a direct industry comparison.

- Increase Efficiency & Reduce Costs: Uncover optimisation potential in processes, governance and IT structures – and reduce unnecessary expenditure on sustainability measures.

- Utilise Strategic Competitive Advantages: Position yourself as a sustainable provider – with a measurable impact on image, employer attractiveness and customer loyalty.

- Gain Regulatory Certainty: Identify gaps with regard to CSRD, SFCR, LkSG & Co. and prepare for upcoming requirements. Respond proactively to market requirements.

- Achieve an Increase in Value: Recognise the economic leverage of your sustainability strategy – from cash flow and market position to profitability.

- Strengthen Trust: Communicate your sustainability performance based on facts – to investors, stakeholders and the public. Make the right decisions for internal processes and external communication.

For whom is the study particularly valuable?

The results of the study, the industry insights and the multidimensional overview of the market are the data-based foundation for the Executive Board and management to review the sustainability strategy for its positive impact on the business result. At the same time, Chief Sustainability Officers (CSO) or Chief Financial Officers (CFO) receive valuable benchmarks and can derive specific findings and recommendations for action from the individual report that make a demonstrable and measurable contribution to the medium and long-term success of the company.

Choose your information package.

Study Sustainability PHI 2025

Contents:

Comprehensive analysis of all 47 private health insurers, detailed methodology, industry insights and aggregated results. Provides a complete overview of the market.

Individual results report ‘Your insurance’

Content:

Detailed evaluation of your specific PHI along the e³ dimensions. Strengths/weaknesses profile, concrete findings and initial recommendations for action.

Individualised Management Workshop

Content:

Joint presentation and discussion of your results (based on the report or as a compact overview). Consolidation of specific fields of action, derivation of next steps and integration into your strategy.

Order form for products for the Study Sustainability PHI 2025

1: Show study participants:

In our study, only the private health insurance companies were examined, explicitly not the parent companies or other, non-topically relevant business entities. Here you can find the complete list of all analysed entities:

- Allianz: Allianz Private Krankenversicherung

- Alte Oldenburger: ALTE OLDENBURGER Krankenversicherung von 1927 V.V.a.G.

- ARAG: ARAG Krankenversicherungs-AG

- Astra: Astra Versicherung AG

- AXA: AXA Krankenversicherung AG

- Barmenia: Barmenia Krankenversicherung AG

- Die Bayerische: BA die Bayerische Allgemeine Versicherung AG

- Concordia: CONCORDIA Krankenversicherungs-AG

- Continentale: Continentale Krankenversicherung a.G.

- DA direkt: Deutsche Allgemeine Versicherung AG

- Debeka: Debeka Krankenversicherungsverein a.G.

- DEVK: DEVK Krankenversicherungs-AG

- Deutsche Familienversicherung: Deutsche Familienversicherung AG (DFV)

- DKV: DKV Deutsche Krankenversicherung AG

- envivas: envivas Krankenversicherung AG

- ERGO: ERGO Krankenversicherung AG

- EUROPA: EUROPA Versicherung AG

- Freie Arztkasse

- Generali: Generali Deutschland Krankenversicherung AG

- GOTHAER: GOTHAER Krankenversicherung AG

- Hallesche ALH Gruppe: HALLESCHE Krankenversicherung a.G.

- HanseMerkur: HanseMerkur Krankenversicherung AG

- HanseMerkus Speziale: HanseMerkur Speziale Krankenversicherung AG

- HUK-Coburg: HUK-COBURG Krankenversicherung AG

- Inter Versicherungsgruppe: INTER Krankenversicherung AG

- janitos: Janitos Versicherung AG

- LIGA: LIGA Krankenversicherung katholische Priester VVaG

- LKH: Landeskrankenhilfe V.V.a.G.

- LVM: LVM Krankenversicherungs-AG

- Mecklenburgische: Mecklenburgische Krankenversicherungs-AG

- münchener verein: Münchener Verein Versicherungsgruppe

- Nürnberger: NÜRNBERGER Krankenversicherung AG

- ottonova: Ottonova Krankenversicherung AG

- VGH: Provinzial Krankenversicherung Hannover AG

- R+V: R+V Krankenversicherung AG

- SDK: Süddeutsche Krankenversicherung a.G.

- Signal Iduna: SIGNAL IDUNA Krankenversicherung a.G.

- SONO: SONO Krankenversicherung a.G.

- UKV: Union Krankenversicherung AG

- uniVersa: uniVersa Krankenversicherung a.G.

- vkb: Bayerische Beamtenkrankenkasse

- vigo: vigo Krankenversicherung VVaG

- vrk: Versicherer im Raum der Kirchen Krankenversicherung AG

- WGV: WGV-Versicherung AG

- Württembergische: Württembergische Krankenversicherung AG

- Würzburger: Würzburger Versicherungs-AG

- Zurich: Zurich Insurance Europe AG Niederlassung für Deutschland